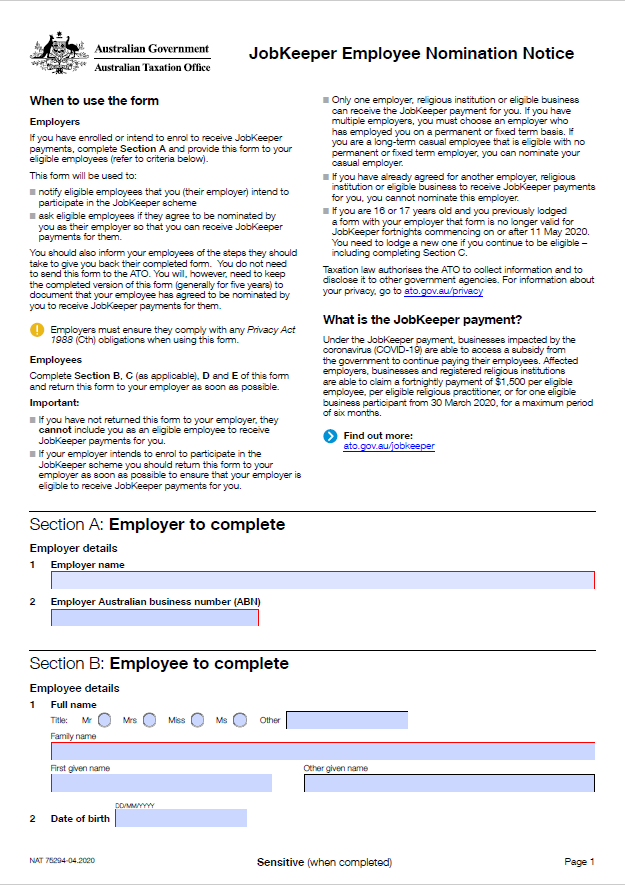

JobKeeper employee nomination

1300apprentice now qualifies for the JobKeeper payment

For this to be passed on to your business, ALL apprentices or trainees need to complete the JobKeeper nomination form.

Whilst 1300apprentice are eligible for JobKeeper, we will continue to access this funding for our shared apprentices and trainees.

Click on the image to download the form now and return to us via email.

FAQ’s

How JobKeeper will be passed onto our host employers.

The JobKeeper payment is assessed over 2 weeks. At the end of the second week 1300apprentice will run a separate payroll which will be the ‘JobKeeper’ top-up payroll for those apprentice’s and trainees deemed eligible.

1300apprentice will fund the top-up amount to ensure that the apprentice or trainee receives $1500 in gross wages each fortnight.

Once 1300apprentice receive payment from the ATO (monthly), your account will be credited gross normal wages for hours worked. See examples.

Example 1 Chad earns $550 weekly. Based on this, Chad’s gross wage for the fortnight is $1100. To top Chad up to the required $1500 per fortnight under JobKeeper, 1300apprentice will fund the additional $400 in the JobKeeper top-up payroll. No invoice will be issued to the host for this top-up.

Once the ATO payment has been received, 1300apprentice will credit the host $1100 towards wages paid and retain the $400 used to top-up Chad’s wages

Example 2 Karen earns $2100 one week and in the second week earns $1600. Based on this Karen’s gross wage for a fortnight is $3700. As this is above the $1500 per fortnight JobKeeper limit, Karen is not entitled to a top-up.

1300apprentice receive the JobKeeper from the ATO monthly and will credit the full amount of $1500 to your account.

Are school based apprentices and trainees eligible? Unfortunately those undertaking a school based apprenticeship or traineeship are not eligible for JobKeeper.

Can 1300apprentice claim both JobKeeper and Supporting Apprentice & Trainee (SAT) Funding? For those employers who have been eligible for SAT funding this will now switch across to JobKeeper.

When did JobKeeper eligibility commence for 1300apprentice? 1300apprentice have been deemed eligible for this as of 11 May 2020.

Apprentice or trainee start dates To be eligible for JobKeeper, the apprentice or trainee must have been employed with 1300apprentice and hosted to you on 1 March.

What if I’ve handed my apprentice back due to a lack of work? If your apprentice was working on 1 March and is still available, we can reinstate their employment and they will be eligible for JobKeeper.

More info about JobKeeper

Read more from the government: JobKeeper payment